How to Account for Customer Loyalty Incentives

Customer loyalty incentives – like points, discounts, or freebies – are a retailer’s gateway to profit. They keep shoppers coming back, boost repeat sales, and turn casual buyers into brand advocates. But here’s the catch: If you don’t account for them properly, your books could be a mess.

Why does accounting for loyalty programs matter?

- Financial Accuracy – Misreported rewards = skewed profit margins.

- Compliance – Stay audit-ready with US generally accepted accounting principles (GAAP)-compliant tracking.

- Smart Decisions – Knowing your true costs helps optimize rewards.

Whether you’re running punch cards, digital tokens, or tiered rewards, this guide breaks down how to account for loyalty points without a headache.

Let’s learn how to master loyalty program accounting.

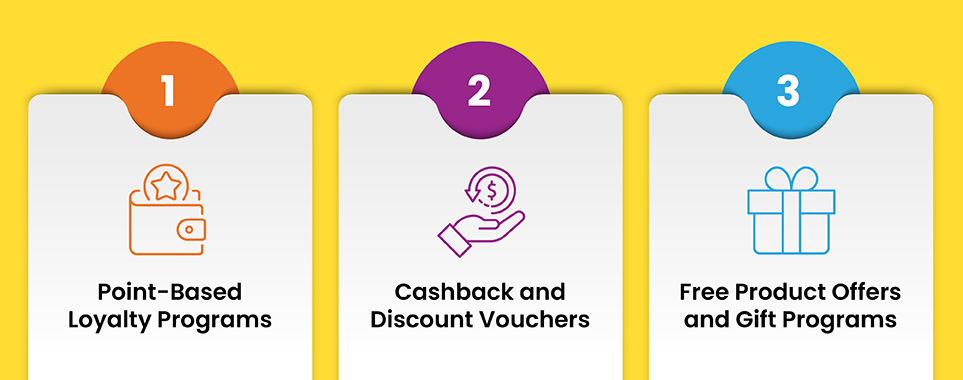

Types of Customer Loyalty Incentives and Their Accounting Treatment

Customer loyalty incentives come in different shapes and sizes – each requiring unique accounting for loyalty programs to maintain financial accuracy. Let’s break down the most common types and their loyalty program accounting treatment.

1. Point-Based Loyalty Programs

How They Work: These programs award points for purchases that customers later redeem as rewards. For proper loyalty program accounting, you must track:

- Point accruals

- Redemption patterns

- Expiration timelines

Related Read: Tips For Running a Points-Based Loyalty Program

Deferred Revenue Recognition

When accounting for loyalty points, treat them as a liability until redeemed. For every $100 in sales where customers earn 10% in points, $10 goes to a “Deferred Revenue – Loyalty Points” account.

Estimate Redemption Rates

Use historical data to predict how many points will be redeemed. If your data shows 70% redemption, only recognize 30% as breakage income. This prevents the common accounting for loyalty points GAAP where liabilities are overstated.

ASC 606/IFRS 15 Compliance Under these standards:

1. Identify performance obligations (sales + future rewards)

2. Allocate transaction price between them

3. Recognize reward revenue only when points are redeemed

Example: A $100 purchase with 10 reward points would split:

$91 to immediate revenue

$9 to deferred liability

2. Cashback and Discount Vouchers

How They Work: These provide immediate or future monetary value. Their accounting for loyalty programs differs by type:

Cashback Treatment

- Record as sales expense when claimed

- Maintain liability account for outstanding cashback

- Recognize expense proportionally if tied to specific purchases

Example: For 5% cashback on a $200 purchase:

- At sale: Debit $10 to “Cashback Liability”

- At redemption: Credit liability, debit “Cashback Expense”

Discount Vouchers Treatment

- Treat as variable consideration under Accounting Standards Codification (ASC) 606

- Reduce revenue at time of redemption

- Track expiration dates and unused balances monthly

3. Free Product Offers and Gift Programs

How They Work: “Buy X, Get Y” promotions require careful loyalty program accounting:

Revenue Allocation

Split transaction value between sold and free items based on standalone prices. For a “Buy 1 Shirt ($50), Get 1 Tie ($30 Free)” offer:

- Total standalone value: $80

- Allocate $50 × (50/80) = $31.25 to shirt

- $18.75 to tie (recognized when delivered)

Inventory Cost Recognition

- Deduct free items at cost (not retail)

- Track separately from regular inventory

Fulfillment Estimation

- Use historical redemption rates

- Adjust liabilities quarterly

- Document estimation methodology

4. Tiered Membership Rewards

How They Work: Multi-level programs (Silver/Gold/Platinum) with escalating benefits require complex loyalty program accounting entries:

Deferred Revenue Recognition

- Spread membership fees over benefit period

- Allocate to each benefit type (shipping, gifts, etc.)

Usage Tracking

- Monitor actual redemption vs projections

- Adjust liability accounts monthly

- Segment by membership tier

Breakage Analysis

- Calculate separately for each tier

- Recognize income only after expiration

- Maintain detailed documentation

Visual Workflow for All Types:

[Transaction] –> Revenue

[Deferral] –> Liability

[Redemption / Breakage] –> Income Statement

[Adjustments] –> Estimate Revisions

Best Practices for Accurate Accounting of Customer Loyalty Incentives

Getting accounting for loyalty programs right isn’t just about compliance – it directly impacts your profitability and customer trust. A single error in tracking redemptions or underestimating liabilities can distort financial statements and trigger audit flags.

Follow these 5 proven practices to maintain airtight loyalty program accounting:

1. Implement Strong Internal Controls

Why it matters:

Without controls, unredeemed points become unclaimed liabilities that haunt your books.

How to execute:

- Segregate duties: Separate teams handling point issuance, redemptions, and financial recording

- Automate tracking: Use POS-integrated software (like Loyal-n-Save) to log transactions in real-time

- Audit trails: Maintain timestamped records of all point adjustments

2. Use Historical Data for Forecasting

Why estimates matter:

Under ASC 606, your loyalty program’s accounting entries must reflect realistic redemption patterns—not guesses.

Actionable steps:

- Analyze 12–24 months of redemption data by reward type

- Segment by customer cohorts (e.g., high vs. low spenders)

- Adjust for seasonality (e.g., holiday redemptions spike 30%)

Related Read: Complete Your Loyalty Program with Deep Data Analytics

3. Stay Aligned With GAAP/IFRS Standards

Critical compliance areas:

- ASC 606/IFRS 15: Split transaction prices between goods sold and future rewards

- Liability timing: Recognize deferred revenue only when points are earned (not when issued)

- Disclosures: Document estimation methodologies in footnotes

Red flag:

A national retailer may face SEC scrutiny for recognizing 100% of breakage income upfront instead of waiting for reward expiration.

4. Regular Reconciliation and Adjustment

Loyalty liabilities aren’t “set and forget.” Reconcile monthly:

4.1) Actual vs. Estimated Redemptions

Compare projected vs. real redemptions

Adjust liability accounts with journal entries

4.2) Breakage Estimate Updates

Re-evaluate expiration assumptions quarterly

Recognize income only after rewards lapse

4.3) Program Term Changes

Remeasure liabilities if point values or expiration rules change

Communicate impacts to stakeholders

4. Disclose Loyalty Programs in Financial Statements

Transparency prevents auditor pushback. Include:

5.1) Program Nature

“Customers earn 1 point per $1 spent, redeemable for discounts or free products”

5.2) Liability Calculation Methods

“Use 3-year weighted average redemption rate”

5.3) Key Assumptions

“Breakage income recognized after 24-month expiration”

5.4) Estimate Changes

“Q3 adjustment: Revised redemption rate from 60% → 55% due to pandemic behavior”

Glossary of Key Terms & Formulas for Loyalty Program Accounting

1. Breakage

Definition: Unredeemed loyalty points/coupons that expire

2. Deferred Revenue (Liability)

Definition: Revenue allocated to unredeemed rewards, recorded as a liability

3. Redemption Rate

Definition: % of issued rewards claimed by customers

4. ASC 606 / IFRS 15

Definition: Accounting standards for revenue recognition, including loyalty rewards

5. Variable Consideration

Definition: Uncertain future obligations (e.g., discount vouchers)

6. Standalone Selling Price (SSP)

Definition: The price of a reward if sold separately

Essential Formulas for Loyalty Program Accounting

1. Breakage Income

Breakage = Unredeemed Points × Redemption Rate % × Reward Value

2. Liability Adjustment for Redemption Rate Changes

Adjustment=Original Liability × (Old Rate %−New Rate %)

3. Free Product Revenue Allocation

Revenue Recognized=Total Sale × (SSP of Paid Item/SSP of Paid + Free Item)

4. Redemption Rate

Redemption Rate = Points Redeemed/Points Issued × 100

Wrapping Up

Customer loyalty incentives are powerful tools for driving repeat sales—but only if you account for them accurately. Mishandling points, cashback, or free rewards can distort your financials, trigger audits, and even mislead stakeholders. Loyalty programs boost sales, but their financial impact must be tracked meticulously as your inventory. Retailers who automate loyalty program accounting gain:

- Accurate profit margins

- Audit-ready compliance

- Data to optimize rewards

Posted on Jul 7, 2025